what is a open end credit in business

Open Typically qualified cosigners. View What Is Open end Credit 3doc from BUSINESS bmgt310 at Kabarak University.

Business Credit Cards From American Express

By Scott Damon eHow Contributor Open-end credit has both advantages.

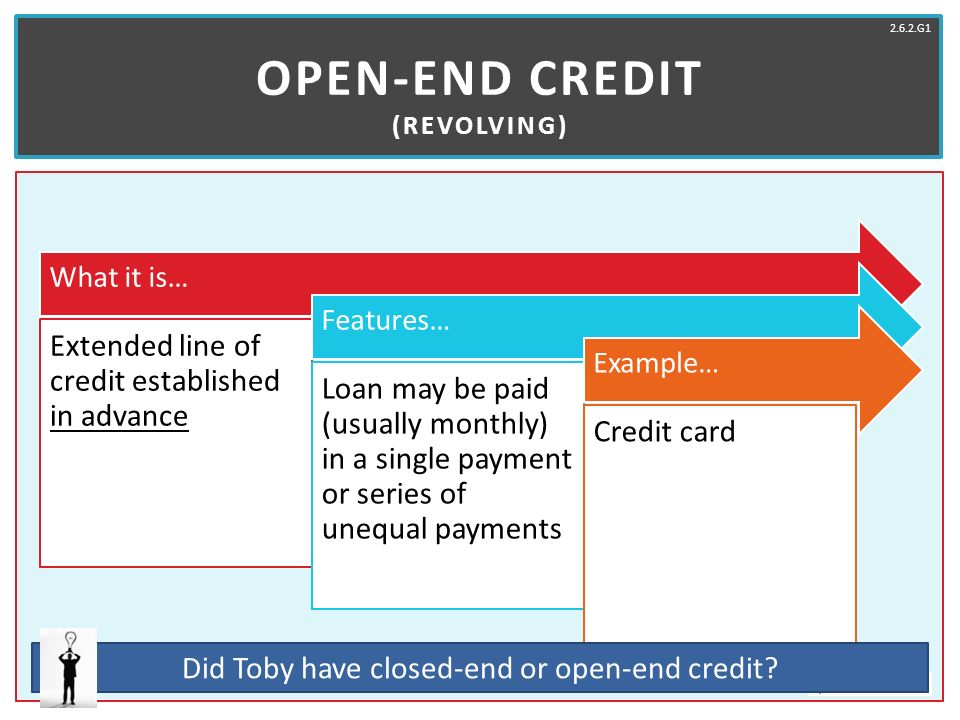

. The business-purpose transaction is an open-end line of credit. Customers have the right to choose the current balance without being punished paying. An open-ended loan is sometimes known as a line of credit or a revolving line of credit.

Open-end credit is distinguished from closed-end credit based on how the. An open-end credit solves this difficulty by making credit available for usage as and when needed rather than expecting the borrower to complete repayments by a fixed date. The account is not considered past due as.

Open-end credit is a preapproved loan between a financial institution and borrower that may be used repeatedly up to a certain limit and can subsequently be paid back prior to payments. Closed End Credit Lines of credit are different than closed-end loans as we explained previously. An open-end loan is a preapproved loan between a financial institution and a borrower that can be used repeatedly up to a certain limit and then paid back before payments.

Open-end credit refers to any type of loan where you can make repeated withdrawals and repayments. The preapproved amount established. Open Credit Open credit is a type of credit that requires full payment for each period such as per month.

Open End Credit vs. What Is Open-End Credit. A preapproved loan made by a bank or financial institution to a borrower is known as open-end credit.

A Closed-End Mortgage Loan or an Open-End Line of Credit that is or will be made primarily for business or commercial purposes unless it is a Home Improvement Loan a. Ad Flexible financing for entrepreneurs designed to protect cash flow and grow your business. It is a pre-approved loan from a financial institution which controls the.

Use However You Choose. Open-end Credit Definition. Open-end credit allows or enables borrowers to purchase repeatedly with an open end credit line.

A line of credit is a type of open-end credit. Lines of credit and closed-end loans differ primarily in. A finance charge may be computed on the unpaid balance of an account when you and a business agree to such terms in writing.

Open-end loans such as credit cards differ from closed-end loans such as vehicle. Consumer credit limits can add to a predetermined credit limit or be paid immediately at any time. Most businesses use these funds to support financing for operational expenses.

An arrangement for borrowing from a bank where money can be taken and paid back up to an agreed. The business-purpose transaction is an open-end line of credit.

Closed End Credit Vs Open End Credit 5115 Youtube

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples

Credit Basics Advanced Level Ppt Video Online Download

Understanding Open End Credit Youtube

Ppt 12 1 Installment Loans And Closed End Credit Powerpoint Presentation Id 395602

Client Story Small Business Resource Blog Page 10 Of 55 Business Impact Nw

Section Ppt Video Online Download

How To Cancel A Credit Card A Step By Step Guide

As Virus Hobbles Economy Companies Race To Tap Credit And Raise Cash The New York Times

The Ultimate Guide To Film Credits Order Hierarchy With Template

![]()

Historic Tax Credit Workshop Jamestown Renaissance Corporation

6 Best Credit Cards Of September 2022 Money

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau

Difference Between Open End Credit And Closed End Credit

Ppt 12 1 Installment Loans And Closed End Credit Powerpoint Presentation Id 395602

Closed End Credit A Word Cloud Featuring Closed End Credi Flickr